Books

& more

Workbook

Here's the companion guide designed to help readers implement the strategies from the book. It includes exercises, prompts, and practical tools to track progress and achieve financial goals.

Interactive exercises to reinforce financial concepts.

Tools to track budgeting, spending, savings.

Prompts to help set and reach personal financial goals.

Space for reflection to monitor progress and stay on track.

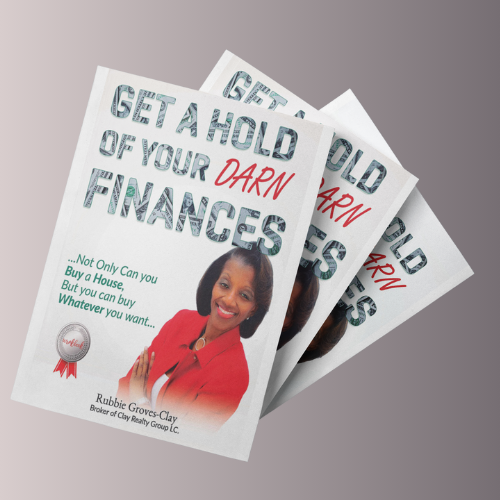

Paperback Book

Get A Hold Of Your Darn Finances" is a practical guide that simplifies financial concepts and helps readers take control of their finances. It offers actionable steps to improve budgeting, credit, and long-term financial stability.

Clear, actionable steps to improve budgeting and money management.

Practical strategies to boost credit scores.

Solutions to overcome common financial obstacles.

Empowerment to set and achieve long-term financial goals.

Book & Workbook

(Combo)

The "Get A Hold Of Your Darn Finances" book and workbook combo offers a complete package for mastering financial literacy at a discounted price. Purchasing the combo provides both the essential knowledge and practical tools to implement strategies for achieving financial stability and success, all while saving money.

A comprehensive guide and practical exercises for financial mastery.Monthly check-ins

Step-by-step instructions for budgeting, credit management, and goal setting.

Interactive workbook tools to track and measure financial progress.

Save money by purchasing the combo, getting both the book and workbook at a discounted price.

Budget Planner

Our Budget Planner is a practical tool designed to help users easily track their income, expenses, and savings. This excel spreadsheet provides a clear, organized layout to manage your finances and stay on track toward your financial goals.

Offers practical tips for reducing debt.

Simple and easy-to-use format for tracking income and expenses.

Provides a clear overview of financial status to guide decision-making.

Helps users identify areas to cut costs and improve savings.

A powerful tool to stay accountable and on track with budgeting goals.

Encourages consistent tracking and reflection on spending.